Inflation & Me

The Takis you used to buy for $2 are now $4, maybe $6. You may have heard about the continuous increase in gas prices or how Dollar Trees everywhere are increasing to $1.25.

When you look at the goods and services industry, prices are higher as of late. Inflation has played a part in the increase or decrease in prices for consumers.

What Is Inflation?

According to Google, inflation is “a general increase in prices and fall in the purchasing value of money. This generally refers to the price level rises of goods and services. These goods and services include housing, clothing, food, transportation, and fuel.

However, the increase in goods and services doesn’t always mean inflation is the case. Sometimes a store could raise the prices because they wanted or needed to.

What Causes Inflation?

A Khan Academy lesson summary commented, “During the 1970s, the U.S. was hit with an oil embargo which dramatically increased the price of energy.”

If you haven’t learned about this in school, this is all about Demand and Pull. But what does demand-pull have anything to do with inflation? Demand-pull describes the effect of an imbalance in aggregate supply and demand. This means when aggregate demand for goods and services rises more rapidly than the productive capacity.

In the 1994 film “The Hudsucker Proxy,” the store owner wasn’t able to sell the hula hoop. Nobody bought it, so he ended up giving it to a kid for free. When other kids saw that kid playing with a hula hoop, every kid wanted one.

From this scene, there was a large amount of supply for this product. Consumers didn’t want to buy it, but their preference changed when they saw another person using the product. The demand for this product increased, and there wasn’t enough supply at the moment because everyone bought the supply they had.

“When the aggregate demand in an economy strongly outweighs the aggregate supply, prices go up. This is the most common cause of inflation.” writes James Chen in Investopedia.

In an economy, if more people want more of a good or service at a low price from a company offering it to them, and the company doesn’t make enough money from its sticker prices, it won’t have the money to produce more of that good or service.

In current years, specifically 2020, 2021, and now 2022, COVID-19 has played a role in causing inflation to rise. There is a decrease in supply and an increase in demand for goods and services. Meanwhile, prices rise along with the need for employees to aid in providing those goods and services.

What Does Inflation Have To Do With Me?

For many people, inflation can increase their cost of living or reduce their spending power. For example, in 2021, Dollar Tree announced that they were raising their prices to $1.25 nationwide. People had speculated inflation had a factor in Dollar Tree raising their prices, but it turned out to be the complete opposite.

According to MarketWatch in a 2021 article published by Tonya Garica, “The higher prices will be in 2,000 Dollar Tree stores in December, with the rollout complete in the first fiscal quarter of 2020”.

However, Dollar Tree announced that the change in price was not because of inflation.

This “allows the company to offer a wider range of merchandise, including items that had been discontinued at the $1 level.” wrote Garica. When inflation rises, you pay more for the goods or services you usually buy. The rise of inflation is not always a bad sign or a good sign.

This has to do with the different types of inflation. These types are creeping inflation, walking inflation, galloping Inflation, hyperinflation, core inflation, deflation, stagflation, wage inflation, asset inflation, asset inflation gas, asset inflation oil, asset inflation food, and asset inflation gold.

To go into more detail and depth about the different types of inflation, check out Kimberely Amadeo’s Balance article, titled Types of Inflation: The 4 Most Critical Plus Nine More.

“It does not affect everyone the same way, ” stated Mary Louise Kelly, a WNYC Radio host.

Inflation can be good or bad for a person. It can cause a person to manage their money better, whether the economy is running at full capacity or not.

At full capacity, when inflation causes higher prices, lenders benefit because it causes an increase in prices, which causes a demand for credit to buy the high-priced goods and services.

When the economy isn’t at full capacity, inflation can help increase production. This benefits the borrowers since they are able to pay back lenders with money worth less than when it was initially borrowed. (Investopedia)

How Does Inflation Look Now?

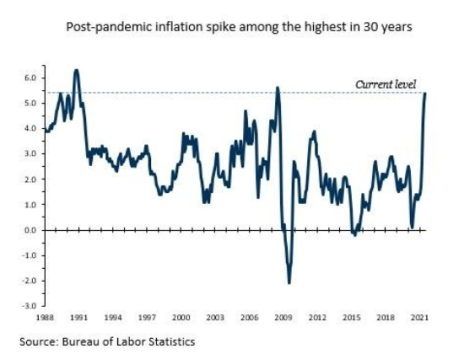

In 2021, the consumer price index went up to 7%, the highest level since 1982, 40 years ago.

The cause was supply and demand due to the coronavirus. The Bureau of Labor Statistics consumer price index identified how prices were 1.05 times higher in 2021 than in 2020.

The inflation rate in 2020 was 1.23%, and in 2021, 4.70%.

The Consumer Price Index (CPI) calculates the inflation rate, which, stated by the U.S. Bureau of Labor Statistics, “is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” The inflation rate for 2022 has not been released thus far. It will be released on February 10, 2022, for the month of January 2022.

Inflation is expected to rise near 5.0% for the beginning of 2022, then begin to slow down, meaning the start of a slight decrease in consumer prices.